Host to Host

¿Manejas un comercio con un alto número de transacciones y gran cantidad de locales, que requieren gestionar de manera centralizada las cuadraturas internas? Transbank tiene una buena alternativa para estos requerimientos. Host to Host, solución que implica un desarrollo en la aplicación de las cajas de tu comercio para integrarla a los equipos provistos por Transbank, conectándose vía enlace dedicado a nuestros servidores, lo que entregará robustez y gran velocidad al proceso de pago y flujo de información.

Cómo funciona

Host to Host requiere de un nivel de integración alto, que consta de las siguientes etapas:

Desarrollo Tu comercio deberá realizar el desarrollo según las especificaciones que te entregará Transbank.

Control de Calidad Este proceso verificará que el desarrollo de integración que hiciste, cumple con los que te entregamos en las especificaciones, o si requiere alguna corrección o mejora.

Etapa piloto En un lugar que acordemos juntos, llevamos a producción tu punto de venta pinpad host, donde con cliente reales haremos monitoreo en conjunto de su funcionamiento, por un periodo acotado de 2 semanas. Evaluamos los resultados, y acordamos masificación, tambien si se requiere algún ajuste.

Masificación Construimos en conjunto un plan de instalación de los puntos de ventas.

Flujo de venta en Pinpad Host:

- El cliente entrega los productos o servicio que desea comprar al vendedor.

- El vendedor realiza la venta en su sistema de caja.

- El vendedor pregunta al cliente como desea pagar, efectivo, tarjeta crédito, tarjeta débito y lo selecciona en la caja.

- La caja invoca al pinpad, pasándole el monto de la venta y la forma de pago crédito o débito

- El cliente opera tarjeta, selecciona cuotas si corresponde, e ingresa su pin

- El pinpad arma el mensaje de requerimiento de venta y lo entrega a la caja.

- La caja toma el mensaje lo entrega al host de comercio y este a su vez al host de Transbank (De ahí su nombre de host to host)

- El mensaje de respuesta recorre el camino inverso hasta llegar al pinpad

- El pinpad verifica la respuesta aprobada o rechaza e integridad del mensaje y entrega resultado a la caja

- La caja imprime los comprobantes de venta.

Equipos y conexiones disponibles

Verifone vx805

Equipo Fijo USB o Serial Pinpad host

Driver

Estos equipos funcionan tanto con puerto serial RS232 y USB (generalmente plug and play), para el cual puedes necesitar instalar un driver de verifone.

Este driver es compatible con los siguientes sistemas operativos, informados por Verifone:

- Windows 10 de 32/64 bits

- Windows 8/8.1 de 32/64 bits

- Windows 7 de 32/64 bits

Por normas PCI, los comercios no deben utilizar un sistema operativo bajo obsolescencia. Además es muy importante mantener su Sistema Operativo con los últimos parches instalados, esto principalmente por un tema de seguridad.

Verifone vx680

Equipo Movil wifi Pinpad host

Verifone e355

Equipo Movil Bluetooth Pinpad host

Funciones de pago disponibles en HOST

- Venta Crédito, con o sin cuotas, propina o donación

- Anulación de venta Crédito.

- Venta Débito, débito con vuelto, propina o donación

- Ventas en modalidad ONUS (tarjetas propias del comercio)

Cómo empezar

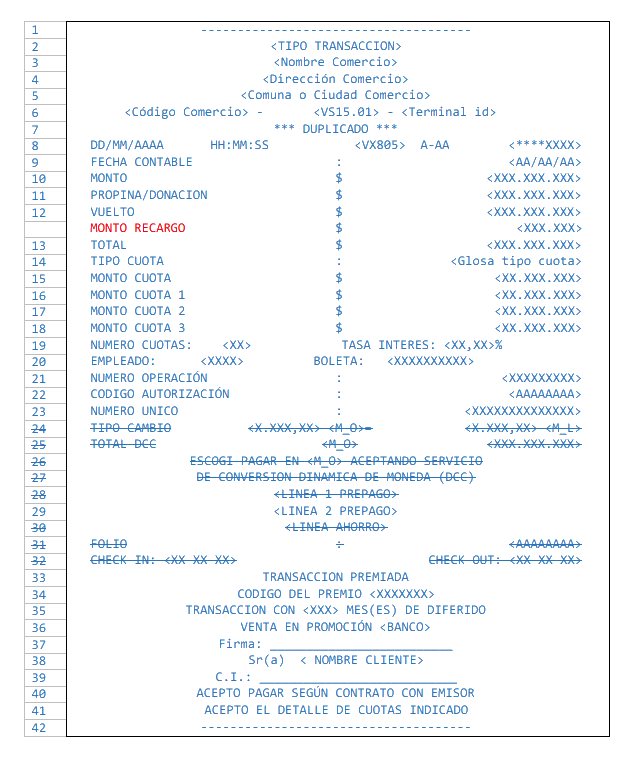

A continuación, verás la documentación asociada a como imprimir los voucher. Puedes revisar la Referencia para ver la información asociada a la comunicación y los comandos.

Voucher

El pinpad entregará el voucher listo para imprimir, pero también entregará todos los datos necesarios para que la misma caja construya el voucher por sí misma. Si se requiere obtener el voucher duplicado la caja debe construir el voucher, sin los datos de PEL y agregando la glosa duplicado.

Consideraciones

Tipo de transacciones

Estas son las glosas que se deberían desplegar en la cabecera del voucher:

| Tipo de Tarjeta | Tipo de transacción |

|---|---|

| CR | VENTA CRÉDITO |

| CR | ANULACIÓN CRÉDITO |

| DB | VENTA DEBITO |

| NB | VENTA NO BANCARIA |

| NB | ANULACIÓN NO BANCARIA |

| DB | VENTA PREPAGO |

| CR | RESERVA |

| CR | ANULACIÓN RESERVA |

| CR | NO SHOW |

| CR | ANULACIÓN NO SHOW |

| CR | CHECK IN |

| CR | ANULACIÓN CHECK IN |

| CR | REAUTORIZACIÓN |

| CR | ANULACIÓN REAUTORIZACIÓN |

| CR | CHECK OUT |

| CR | ANULACIÓN CHECK OUT |

| CR | CARGO DEMORADO |

| CR | ANULACIÓN CARGO DEMORADO |

| DB | RETIRO EFECTIVO DEBITO |

| CR | AVANCE EFECTIVO CRÉDITO |

| CR | ANULACIÓN AVANCE EFECTIVO CRÉDITO |

Tipos de tarjeta

Considerar que las tarjetas emitidas por las casas comerciales bajo una marca como VISA o Master se consideran bancarias ya no tarjetas no bancarias. Las tarjetas de prepago se considerarán tarjetas de débito.

| Código | Glosa |

|---|---|

| CR | CRÉDITO |

| DB | DÉBITO |

| NB | NO BANCARIA |

| PR | PREPAGO |

Marcas de tarjetas

| Nombre | Abreviación |

|---|---|

| VISA | VI |

| MASTERCARD | MC |

| AMEX | AX |

| DINERS | DC |

| DISCOVER | DC |

| MAGNA | MG |

| PRESTO | TP |

| MAS | TM |

| RIPLEY | TR |

| RIPLEY | RP |

| CMR | TC |

| DEBITO | DB |

| ELECTRON | EL |

| MAESTRO | MT |

| PREPAGO | PR |

Orden de impresión

La idea de este voucher es que sea la única salida para cualquier tipo de voucher de Transbank, al ser un voucher único, independiente del tipo de transacción siempre se hacen las mismas validaciones, para ver si se imprime o no cada campo, sea voucher de crédito, débito o anulación de crédito.

Siempre se deben imprimir dos copias de voucher una para el comercio y otra para el cliente. En el caso de voucher con firma si el comercio lo desea puede no imprimir en la copia del comercio, las líneas de firmas, nombre del cliente y rut, en el voucher del comercio debe estar firmado si aplica.

El orden de impresión debe ser:

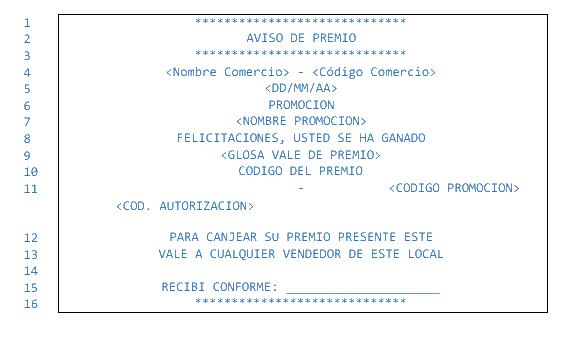

- Voucher de premio de TBK

- Voucher del cliente de TBK

- Voucher del comercio de TBK

Cualquier variación al orden o formato del voucher debe ser autorizada por Transbank

Otras consideraciones

Algunas consideraciones en la impresión de los voucher de Transbank

- Los vouchers deben contener exclusivamente la información solicitada en este manual. Cualquier excepción debe ser autorizada y formalizada por Transbank.

- El nombre del cliente se puede imprimir solo en voucher con firma

- Las líneas de vuelto no deben imprimirse si no están siendo utilizadas.

- Las líneas de donación o propina no deben imprimirse si no están siendo utilizadas.

- Los vouchers de premio NO deben ser impresos en papel auto copiativo. En caso de que el cliente solamente posea impresoras que utilicen papel autocopiativo, debe notificarse a Transbank de esta situación, y es este último quien debe autorizar el que sea aceptado este tipo de impresión, pudiendo quedar fuera la funcionalidad de promociones en línea.

- Solo debe generarse una copia de un voucher de premio, frente a cualquier condición de borde si no se pudo imprimir el voucher, se pierde el premio, en el duplicado no debe figurar nada al respecto.

- NO es posible reimprimir el voucher de premio ni realizar alusiones de premio en los vouchers de Transbank en caso de la impresión de un duplicado.

- El código del premio y las glosas son entregadas por el PINPAD luego de validar la respuesta del requerimiento.

- La impresión de voucher DEBE ser realizada en forma automática, al aprobarse la transacción, no opcional ni manual. No debe depender de un enter en caja para liberar la impresión

- Para los casos en que sea necesaria la firma del tarjetahabiente, la impresión DEBE suponer un espacio adecuado para dicha operación.

- El inicio de una nueva transacción DEBE realizarse SOLO al momento de finalizada la impresión del voucher de la transacción anterior, NUNCA durante su impresión o reimpresión, dado que la transacción se da por finalizada al momento de la impresión del voucher o su reimpresión.

- La separación entre los vouchers (de transacciones (original/copia), de premio) puede ser física (corte) o delimitada por líneas punteadas.

- Lo último que debe ser impreso es el voucher Transbank

- El voucher en impresora fiscal va entre las glosas. “INICIO COMENTARIO” y “FIN COMENTARIO”. Dado el número de líneas posibles de imprimir en este tipo de impresoras, está permitido la eliminación de líneas en blanco para que el voucher pueda ser impreso correctamente. Cada voucher podría ir separado por un inicio y fin de comentario, esto es el voucher de pel el de cliente y el del comercio.

Voucher de venta o anulaciones

Voucher Pel y reimpresión

Solo se permite imprimir 1 vez el voucher original y el voucher de PEL, si existe algún problema con

la impresión del voucher original se debe abortar la impresión y permitir obtener duplicado.

Original:

- Voucher de PEL

- Voucher 1 comercio/cliente

- Voucher 2 comercio/cliente

Duplicados:

- Voucher 1 comercio/cliente “duplicado sin glosa pel”

- Voucher 2 comercio/cliente “duplicado sin glosa pel”

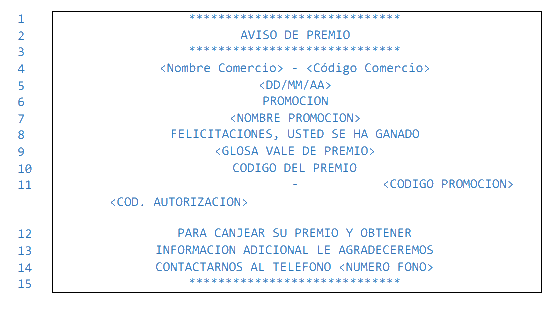

Voucher pel 1 - Premiación en línea

Se debe imprimir este voucher solo si: COMANDO H505 CAMPO TIPO DE VOUCHER = Entrega Pto. de Venta

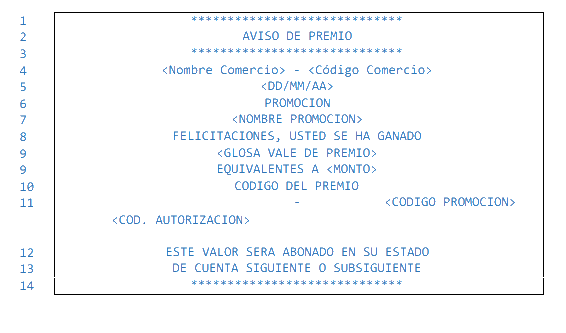

Voucher pel 2 - Premiación en línea

Se debe imprimir este voucher solo si: COMANDO H505 CAMPO TIPO DE VOUCHER = |2| Entrega Diferida

Voucher pel 3 - Premiación en línea

Se debe imprimir este voucher solo si: COMANDO H505 CAMPO TIPO DE VOUCHER = |3| Devolución al Tarjeta Habiente

ANEXO ONUS

Objetivos

Esta documentación describe la forma de operar, la funcionalidad y el detalle de la mensajería de un PINPAD TRANSBANK trabajando bajo la modalidad OnUs.

La aplicación del PINPAD, supone la existencia de un ECR inteligente (por ejemplo una caja registradora) que enviará los requerimientos al PINPAD, para que este los procese y entregue los resultados cuando corresponda.

Audiencia

Para entender completamente esta documentación es necesario tener conocimientos transaccionales y conocer las funciones implementadas habitualmente en los PINPAD usados en las transacciones bancarias.

En particular este manual está dirigido exclusivamente a los comercio ONUS que tienen tarjetas propias y utilizan el pinpad de Transabank para leer sus tarjetas, pero las transacciones las realizan y autorizan ellos mismos.

Alcance

Aplica para el equipo Verifone vx805 (Conexión Serial o USB)

Aplica para el equipo Verifone e355 (Conexión Bluetooth)

Puedes revisar la Referencia para ver la información asociada a la comunicación y los comandos.

Especificaciones técnicas y salidas especiales

Cuadratura y liquidación

En esta sección se describen los archivos de cuadratura y liquidación que se entregan al cliente que utiliza el servicio de Salidas Especiales. Los archivos de cuadratura (conciliación) son archivos planos que contienen los registros de las transacciones (de venta y anulación) efectuadas en un comercio dentro de un periodo determinado. Los archivos de liquidación son archivos planos que contienen los registros de los abonos y retenciones hechas sobre la cuenta del comercio dentro de un período determinado.

Distribución

Los archivos de cuadratura y liquidación son colocados periódicamente en una casilla SFTP creada en forma exclusiva para el respectivo comercio, para que este los descargue a su propio sistema. La siguiente tabla indica la frecuencia y horario de colocación de archivos de cuadratura y liquidación en la casilla:

| Archivo | Periodo abarcado | Colocación en casilla | Horario de copia de archivos |

|---|---|---|---|

| Cuadratura | 00ºº hrs día – 00ºº hrs día siguiente | Todos los días | 12:00 Martes 14:00 |

| Liquidación | 00ºº hrs día – 00ºº hrs día siguiente | Día hábil | 12:00 Martes 14:00 |

Acceso a la casilla

Los comercios deberán utilizar alguna aplicación del tipo cliente SFTP disponible en el mercado para el acceso a la casilla, algunas de estas pueden ser Filezilla, WinSCP, PuTTY, MobaxTerm

El nombre de los archivos de las Salidas especiales (SSEE) se generará en forma dinámica a partir de los datos ingresados en el enrolamiento más la fecha de proceso

<Formato de Salida>_<Periodo>_<Agrupación Archivo de Salidas>_<RutComercio ó CódigoComercio>_<Tipo Conexion>_<Agrupación de Transacciones>_<Número Agrupación>Formato de Salida

- LDN: Liquidación de débito

- LCN: Liquidación de crédito

- CDN: Cuadratura de débito

- CCN: Cuadratura de crédito

Periodo

- Diaria: Se genera un archivo diario en base a la fecha de proceso

- Mensual: Se genera un archivo por mes. Fecha asociada al penúltimo día hábil del mes

Agrupación Archivo de Salidas

- RE: Archivo con información única asociada al RUT enrolado (Genera un archivo)

- CC: Archivo con información separada por código de comercio de la transacción (genera un archivo diferente para cada código de comercio)

Tipo Conexión

- Se genera un único archivo. Información de archivos no es separada por tipo de conexión (cuando es un archivo único no es parte del nombre)

- Cuando se genera un archivo para transacciones con tipo de conexión presencial y no presencial o NP: No presencial o PR: presencial

Agrupación de transacciones

- Cuando esta agrupado por RUT no se incluye en el nombre del archivo

- RB: Rubro

Número Agrupación

- Corresponderá al número del Rubro enrolado.

Archivo de cuadratura crédito (L3)

A continuación, se describe en detalle la estructura de los registros de los archivos de cuadratura crédito. Cada archivo tiene un registro de encabezamiento (“header”), luego un registro por cada transacción efectuada en el periodo abarcado y al final un registro de pie (“footer”). El archivo de cuadraturas crédito contiene el registro al detalle de las transacciones financieras efectuadas con tarjeta de crédito. Contiene tanto las transacciones procesadas en forma presencial como no presencial.

Header

| Nombre | Descripción | Formato | Largo | Total |

|---|---|---|---|---|

| Dktt-Hr-Reg | "HR" | Alfanumérico | 2 | 2 |

| Dktt-Hr-Fech-Proc | Fecha De Proceso Formato "AAMMDD" El día en el que se procesa el archivo es el día hábil inmediato al período abarcado. |

Numérico | 6 | 8 |

| Dktt-Hr-Hora-Proc | Hora De Proceso Formato "HHMMSS" | Numérico | 6 | 14 |

| Dktt-Hr-Glosa | Nombre Del Comercio Nombre de Fantasía del comercio |

Alfanumérico | 25 | 39 |

| Filler | Disponible | Alfanumérico | 282 | 321 |

Footer

| Nombre | Descripción | Formato | Largo | Total |

|---|---|---|---|---|

| Dktt-Tr-Reg | Valor fijo "TR" | Alfanumérico | 2 | 2 |

| Dktt-Tr-Fech-Proc | Fecha De Proceso Formato "AAMMDD" | Numérico | 6 | 8 |

| Dktt-Tr-Hora-Proc | Hora De Proceso Formato "HHMMSS" | Numérico | 6 | 14 |

| Dktt-Tr-Cant-Reg | Total De Registros | Numérico | 7 | 21 |

| Dktt-Tr-Acum-Monto | Total. 11 enteros 2 decimales | Numérico | 13 | 34 |

| Dktt-Tr-Fech-Desde | Fecha menor de Txs Formato "AAMMDD". De entre las transacciones registradas en el archivo indica la fecha en la que se realizó la más temprana. |

Numérico | 6 | 40 |

| Dktt-Tr-Hora-Desde | Hora menor de Txs Formato "HHMMSS". De entre las transacciones registradas en el archivo indica la hora en la que se realizó la más temprana. |

Numérico | 6 | 46 |

| Dktt-Tr-Fech-Hasta | Fecha mayor de Txs. Formato "AAMMDD". De entre las transacciones registradas en el archivo indica la fecha en la que se realizó la más tardía. |

Numérico | 6 | 52 |

| Dktt-Tr-Hora-Hasta | Hora mayor de Txs. Formato "HHMMSS". De entre las transacciones registradas en el archivo indica la hora en la que se realizó la más tardía |

Numérico | 6 | 58 |

| Filler | Disponible | Alfanumérico | 263 | 321 |

Detalle La siguiente tabla describe cada uno de sus campos:

| Nombre | Descripción | Formato | Largo | Total |

|---|---|---|---|---|

| DSK-DT-REG | Tipo de Registro Valor fijo “DT” | Alfanumérico | 2 | 2 |

| DSK-TYP | Tipo de Transacción 0210 : venta en línea 0420 : reversa | Numérico | 4 | 6 |

| DSK-TC | Código de Transacción4 "10" : Compra "18" : Compra con vuelto "30" : Retención | Numérico | 2 | 8 |

| DSK-TRAN-DAT | Fecha de la Transacción Formato “AAMMDD”. Corresponde a la fecha en la cual Transbank emitió respuesta a la transacción |

Numérico | 6 | 14 |

| DSK-TRAN-TIM | Hora de la Transacción Formato “HHMMSS”. Corresponde a la hora en la cual Transbank emitió respuesta a la transacción |

Numérico | 6 | 20 |

| DSK-ID-RETAILER | Código del Comercio Prestador | Numérico | 12 | 32 |

| DSK-NAME-RETAILER | Nombre del Comercio Nombre de fantasía del comercio |

Alfanumérico | 20 | 52 |

| DSK-CARD | Número de Tarjeta Sólo aparecen los últimos 4 dígitos, los demás están enmascarados con * |

Alfanumérico | 19 | 71 |

| DSK-AMT-1 | Monto de la Compra. 11 enteros 2 decimales | Numérico | 13 | 84 |

| DSK-AMT-2 | Monto del Vuelto. 11 enteros 2 decimales | Numérico | 13 | 97 |

| DSK-AMT-PROPINA | Monto Propina. 7 enteros 2 decimales | Numérico | 9 | 106 |

| DSK-RESP-CDE | Código de Respuesta Emitido por Base-24. Los valores entre 000 y 009 indican transacción aprobada. |

Alfanumérico | 3 109 | |

| DSK-APPRV-CDE | Código de Aprobación “O De Autorización”. Entregado por el Emisor. |

Alfanumérico | 8 | 117 |

| DSK-TERM-NAME | Código del terminal POS Terminal ID | Alfanumérico | 16 | 133 |

| DSK-ID-CAJA | Identificador de la Caja | Alfanumérico | 16 | 149 |

| DSK-NUM-BOLETA | Número de Boleta | Alfanumérico | 10 | 159 |

| DSK-FECHA-PAGO | Fecha de Pago 1 día hábil después de la fecha de Proceso del archivo |

Numérico | 6 | 165 |

| DSK-IDENT | identificador del Host Corresponde al “Identificador del Comercio” que aparece al principio del nombre del nombre del archivo |

Alfanumérico | 2 | 167 |

| DSK-ID-RETAILER | Código del Comercio Responsable Código del comercio intermediario (si lo hubiese) entre el Comercio y la tarjeta habiente |

Numérico | 8 | 175 |

| DSK-ID-COD-SERVI | Código de Servicio | Alfanumérico | 20 | 195 |

| DSK-ID-NRO-UNICO | Número único Asignado por el comercio |

Alfanumérico | 26 | 221 |

| DSK-PREPAGO | Prepago Valor “P” para registros que provienen de prepago. En blanco si se trata de una transacción de otro producto. |

Alfanumérico | 1 | 222 |

| FILLER | Disponible | Alfanumérico | 18 | 240 |

Archivo de cuadratura débito (L3)

El archivo de cuadraturas débito contiene el registro al detalle de las transacciones financieras efectuadas con tarjeta de débito. Contiene tanto las transacciones procesadas en forma presencial como no presencial.

Header

| Nombre | Descripción | Formato | Largo | Total |

|---|---|---|---|---|

| Dktt-Hr-Reg | Tipo de registro | Alfanumérico | 2 | 2 |

| Dktt-Hr-Fech-Proc | Fecha De Proceso | Numérico | 6 | 8 |

| Dktt-Hr-Hora-Proc | Hora De Proceso | Numérico | 6 | 14 |

| Dktt-Hr-Glosa | Nombre Del Comercio Nombre de Fantasía del comercio |

Alfanumérico | 25 | 39 |

| Filler | Disponible | Alfanumérico | 201 | 240 |

Footer

| Nombre | Descripción | Formato | Largo | Total |

|---|---|---|---|---|

| DSK-TR-REG | Tipo de Registro. Valor "TR" | Alfanumérico | 2 | 2 |

| DSK-TR-FECHA-PROC | Fecha de Proceso | Numérico | 6 | 8 |

| DSK-TR-HORA-PROC | Hora de proceso | Numérico | 6 | 14 |

| DSK-TR-TOT-REG | Total Registros | Numérico | 7 | 21 |

| DSK-TR-MONTO | Monto Total. 11 enteros 2 decimales | Numérico | 13 | 34 |

| DSK-TR-MONTO-COM | Monto Comisiones Total. 11 enteros 2 | Numérico | 13 | 47 |

| FILLER | Alfanumérico | 193 | 240 |

Detalle

| Nombre | Descripción | Formato | Largo | Total |

|---|---|---|---|---|

| DSK-DT-REG | Tipo de Registro Valor fijo “DT” | Alfanumérico | 2 | 2 |

| DSK-TYP | Tipo de Transacción 0210 : venta en línea 0420 : reversa | Numérico | 4 | 6 |

| DSK-TC | Código de Transacción4 "10" : Compra "18" : Compra con vuelto "30" : Retención | Numérico | 2 | 8 |

| DSK-TRAN-DAT | Fecha de la Transacción Formato “AAMMDD”. Corresponde a la fecha en la cual Transbank emitió respuesta a la transacción |

Numérico | 6 | 14 |

| DSK-TRAN-TIM | Hora de la Transacción Formato “HHMMSS”. Corresponde a la hora en la cual Transbank emitió respuesta a la transacción |

Numérico | 6 | 20 |

| DSK-ID-RETAILER | Código del Comercio Prestador | Numérico | 12 | 32 |

| DSK-NAME-RETAILER | Nombre del Comercio Nombre de fantasía del comercio |

Alfanumérico | 20 | 52 |

| DSK-CARD | Número de Tarjeta Sólo aparecen los últimos 4 dígitos, los demás están enmascarados con * |

Alfanumérico | 19 | 71 |

| DSK-AMT-1 | Monto de la Compra. 11 enteros 2 decimales | Numérico | 13 | 84 |

| DSK-AMT-2 | Monto del Vuelto. 11 enteros 2 decimales | Numérico | 13 | 97 |

| DSK-AMT-PROPINA | Monto Propina. 7 enteros 2 decimales | Numérico | 9 | 106 |

| DSK-RESP-CDE | Código de Respuesta Emitido por Base-24. Los valores entre 000 y 009 indican transacción aprobada. |

Alfanumérico | 3 109 | |

| DSK-APPRV-CDE | Código de Aprobación “O De Autorización”. Entregado por el Emisor. |

Alfanumérico | 8 | 117 |

| DSK-TERM-NAME | Código del terminal POS Terminal ID | Alfanumérico | 16 | 133 |

| DSK-ID-CAJA | Identificador de la Caja | Alfanumérico | 16 | 149 |

| DSK-NUM-BOLETA | Número de Boleta | Alfanumérico | 10 | 159 |

| DSK-FECHA-PAGO | Fecha de Pago 1 día hábil después de la fecha de Proceso del archivo |

Numérico | 6 | 165 |

| DSK-IDENT | identificador del Host Corresponde al “Identificador del Comercio” que aparece al principio del nombre del nombre del archivo |

Alfanumérico | 2 | 167 |

| DSK-ID-RETAILER | Código del Comercio Responsable Código del comercio intermediario (si lo hubiese) entre el Comercio y la tarjeta habiente |

Numérico | 8 | 175 |

| DSK-ID-COD-SERVI | Código de Servicio | Alfanumérico | 20 | 195 |

| DSK-ID-NRO-UNICO | Número único Asignado por el comercio |

Alfanumérico | 26 | 221 |

| DSK-PREPAGO | Prepago Valor “P” para registros que provienen de prepago. En blanco si se trata de una transacción de otro producto. |

Alfanumérico | 1 | 222 |

| FILLER | Disponible | Alfanumérico | 18 | 240 |

Archivo de liquidaciones crédito (L5)

El archivo de liquidaciones crédito contiene el registro al detalle de los abonos y retenciones sobre la cuenta del comercio dentro de un período determinado por transacciones con tarjeta de crédito.

Header

| Nombre | Descripción | Formato | Largo | Total |

|---|---|---|---|---|

| Abono - Desde | Fecha inicio periodo de abono ddmmaaaa | Numérico | 8 | 8 |

| Filler | Relleno | Alfanumérico | 1 | 9 |

| Abono – Hasta | Fecha de término periodo de abono ddmmaaaa | Numérico | 8 | 17 |

| Filler | Relleno | Alfanumérico | 1 | 18 |

| Proceso – Fecha | Fecha de proceso, en formato ddmmaaaa | Numérico | 8 | 26 |

| Filler | Relleno | Alfanumérico | 1 | 27 |

| Abono - Fecha | Fecha de pago de las transacciones, en formato ddmmaaaa | Numérico | 8 | 35 |

SI largo de código cliente es menor que 4

| Nombre | Descripción | Formato | Largo | Total |

|---|---|---|---|---|

| Código cliente | Número interno de cliente | Numérico | 3 | 38 |

| Nombre de cliente | Nombre del comercio | Alfanumérico | 20 | 58 |

| Filler | Relleno | Alfanumérico | 76 | 134 |

| Filler | Contiene " HEADER" | Alfanumérico | 6 | 140 |

| Filler | Relleno | Alfanumérico | 89 | 229 |

SI largo de código cliente es mayor que 3

| Nombre | Descripción | Formato | Largo | Total |

|---|---|---|---|---|

| Código cliente | Número interno de cliente | Numérico | 5 | 40 |

| Nombre de cliente | Nombre del comercio | Alfanumérico | 20 | 60 |

| Filler | Relleno | Alfanumérico | 74 | 134 |

| Filler | Contiene " HEADER" | Alfanumérico | 6 | 140 |

| Filler | Relleno | Alfanumérico | 89 | 229 |

Footer

| Nombre | Descripción | Formato | Largo | Total |

|---|---|---|---|---|

| Sal - Contador | Número de transacciones a abonar | Numérico | 10 | 10 |

| Filler | Relleno | Alfanumérico | 1 | 11 |

| Sal - Monto | Monto total de las ventas a abonar (11 enteros, 2 decimales) | Numérico | 13 | 24 |

| Filler | Relleno | Alfanumérico | 1 | 25 |

| Sal - Rret. | Número de retenciones | Numérico | 10 | 35 |

| Filler | Relleno | Alfanumérico | 1 | 36 |

| Sal - Ret. | Monto total de retenciones (11 enteros, 2 decimales) | Numérico | 13 | 49 |

| Filler | Relleno | Alfanumérico | 1 | 50 |

| Sal - Ceic | Monto total de comisión más IVA de la comisión (Venta) (11 enteros, 2 decimales) | Numérico | 13 | 63 |

| Sal - caeica | Monto total de comisión adicional más IVA adicional de la comisión (11 enteros, 2 decimales) | Numérico | 13 | 76 |

| Sal - dceic | Monto total de comisión más IVA de la comisión (Retenciones) (11 enteros, 2 decimales) | Numérico | 13 | 89 |

| Sal - dcaeica | Monto total de comisión adicional más IVA adicional de la comisión (Retenciones) (11 enteros, 2 decimales). | Numérico | 13 | 102 |

| Filler | Relleno | Alfanumérico | 32 | 134 |

| Filler | Contiene " FOOTER" | Alfanumérico | 6 | 140 |

| Filler | Relleno | Alfanumérico | 89 | 229 |

Detalle

| Nombre | Descripción | Formato | Largo | Total |

|---|---|---|---|---|

| Liq-Numc | Código de Comercio | Numérico | 8 | 8 |

| Liq-Fproc | Fecha de Proceso, en formato ddmmaaaa | Numérico | 8 | 16 |

| Liq-Fcom | Fecha de la venta o retención, en formato ddmmaaaa | Numérico | 8 | 24 |

| Liq-Micr | Número de Microfilm | Alfanumérico | 8 | 32 |

| Liq-Numta | Número de Tarjeta SI numPedido es nulo | Alfanumérico | 19 | 51 |

| Liq-Marca | Tipo de Tarjeta. Los valores son, VI: Visa; MC: Master; DI: Diners; AX: Amex | Alfanumérico | 2 | 53 |

| Liq-Monto | Monto de la venta o retención (11 enteros, 2 decimales) | Numérico | 11 | 64 |

| Liq-Moneda | Tipo de Moneda. 0: pesos; 1: dólar. | Numérico | 1 | 65 |

| Liq-Txs | Tipo de transacción. Si es venta:”VA” Venta a abonar “VP” Venta pareada con retención (“RP”). Si es retención: “RP” Retención pareada con venta (“VP”) “RA” Retención total aplicada “RC” Saldo de retención aplicada en forma parcial. “RE” Retención Pendiente |

Alfanumérico | 2 | 67 |

| Liq-Rete | Atributo de la transacción. Si es venta a abonar o pareada va “0000”. Si es venta 3CSI, va “C3C” donde es el número de la cuota. Si es venta Cuotas Comercio, va “I&&&”, donde &&& es la cantidad de cuotas, alineada a la derecha. Si es venta NCuotas, va “nnSI”, donde nn indica el número de cuotas (02 a 24) y SI indica: cuotas sin interés.Si es retención, va el código de retención. | Alfanumérico | 4 | 71 |

| Liq-Cprin | Código de casa matriz del comercio. Si LiqNumc es la matriz, lleva “99999999”. | Numérico | 8 | 79 |

| Liq-Fpago | Fecha de pago, en formato ddmmaaaa | Numérico | 8 | 87 |

| Liq-orpedi | Número de Orden de Pedido o Código de Barra | Alfanumérico | 26 | 113 |

| Liq-codaut | Código de autorización de transacción | Alfanumérico | 6 | 119 |

| Liq-cuotas | Número de cuota que se está abonando y que opera para ventas efectuadas con los productos Ncuotas o Ventas en cuotas sin intereses. | Numérico | 2 | 121 |

| Liq-vci | Valor de autentificación de la transacción (Venta) | Numérico | 4 | 125 |

| Liq-ceic | Valor de la comisión más IVA de la comisión(Venta) | Numérico | 11 | 136 |

| Liq-caeica | Valor de la comisión adicional más IVA adicional de la comisión | Numérico | 11 | 147 |

| Liq-dceic | Valor de la comisión más IVA de la comisión(Retenciones) | Numérico | 11 | 158 |

| Liq-dcaeica | Valor de la comisión adicional más IVA adicional de la comisión (Retenciones) | Numérico | 11 | 169 |

| Liq-ntc | número total de cuotas de la venta original y que opera para ventas efectuadas con los productos NCuotas o Ventas en cuotas sin intereses. | Numérico | 2 | 171 |

| Liq_Nombre_banco | Nombre del banco indicará el nombre del banco | Alfabético | 35 | 206 |

| Liq_Tipo_cuenta_banco | Tipo de la cuenta del banco asociada al abono | Alfabético | 2 | 208 |

| Liq_Número_cuenta_banco | Número de la cuenta del banco asociada al abono | Alfabético | 18 | 226 |

| Liq_Moneda_cuenta_banco | Moneda de la cuenta de abono seleccionada | Alfabético | 3 | 229 |

Archivo de liquidaciones débito (L5)

El archivo de liquidaciones débito contiene el registro al detalle de los abonos y retenciones sobre la cuenta del comercio dentro de un período determinado por transacciones con tarjeta de débito.

Header

| Nombre | Descripción | Formato | Largo | Total |

|---|---|---|---|---|

| Abono-Desde | Fecha inicio periodo de abono Formato ‘ddmmaa’ | Numérico | 6 | 6 |

| Filler | Disponible | Alfanumérico | 1 | 7 |

| Abono-Hasta | Fecha final periodo de abono Formato ‘ddmmaa’ | Numérico | 6 | 13 |

| Filler | Disponible | Alfanumérico | 4 | 17 |

| Liqu-Fecha | Fecha de liquidación Formato ‘ddmmaa’ | Numérico | 6 | 23 |

| Filler | Disponible | Alfanumérico | 1 | 24 |

| Nombre-Fan | Nombre de fantasía del comercio | Alfanumérico | 25 | 49 |

| Header | Indicador de registros “HEADER” | Alfanumérico | 6 | 55 |

| Filler | Disponible | Alfanumérico | 160 | 215 |

Footer

| Nombre | Descripción | Formato | Largo | Total |

|---|---|---|---|---|

| Liq-Ncom | Sumatoria de registros de detalle Para registros de detalle con Liq-Ttra = “00” | Numérico | 10 | 10 |

| Filler | Disponible | Numérico | 1 | 11 |

| Liq-Tcom | Sumatoria de campo Liq-Amt1. 11 enteros 2 decimales Para registros de detalle con Liq-Ttra = “00” |

Numérico | 13 | 24 |

| Filler | Disponible | Numérico | 1 | 25 |

| Liq-Nret | Sumatoria de registros de detalle de retenciones | Numérico | 10 | 35 |

| Filler | Disponible | Alfanumérico | 1 | 36 |

| Liq-Mret | Sumatoria de campo Liq-Amt1, para registros de detalle con Liq-Ttra =”03”. 11 enteros 2 decimales | Numérico | 13 | 49 |

| Liq-Vret | Valores fijos de “000000000” | Numérico | 9 | 58 |

| Liq-Tret | Valores fijos de “0000000000” | Numérico | 10 | 68 |

| Footer | Indicador del tipo de registros “FOOTER” | Alfanumérico | 6 | 74 |

| Liq-Tot-Com-comiv | Sumatoria de la comisión más IVA de la comisión (Venta). 11 enteros 2 decimales | Numérico | 13 | 87 |

| Filler | Disponible | Alfanumérico | 1 | 88 |

| Liq-Tot-decom-ivcom | Sumatoria de la comisión más IVA de la comisión (Retenciones). 11 enteros 2 decimales | Numérico | 13 | 101 |

| Liq-Fill | Alfanumérico | 114 | 215 |

Detalle

| Nombre | Descripción | Formato | Largo | Total |

|---|---|---|---|---|

| Liq-Ccre | Código de Comercio interno de Transbank Es el código asignado al comercio por Transbank. No incluye el prefijo 5970. | Numérico | 8 | 8 |

| Liq-Fpro | Fecha de proceso del archivo Formato ‘ddmmaa’. Corresponde a la fecha de proceso de la respectiva transacción. | Numérico | 6 | 14 |

| Liq-Fcom | Fecha de compra Formato ‘ddmmaa’. Corresponde a la fecha en la cual se realizó la transacción | Numérico | 6 | 20 |

| Liq-Appr | Código de Autorización Entregado por el autorizador | Alfanumérico | 6 | 26 |

| Liq-Pan | Número de la tarjeta Sólo últimos cuatro dígitos, demás caracteres con asteriscos | Alfanumérico | 19 | 45 |

| Liq-Amt1 | Monto de la transacción. 11 enteros 2 decimales | Numérico | 13 | 58 |

| Liq-Ttra | Tipo de transacción = 0 : compra abonada mayor que 0 : retención |

Numérico | 2 | 60 |

| Liq-Cpri | Valor fijo “99999999” | Numérico | 8 | 68 |

| Liq-Marc | Retenciones Valor “RE” : para retenciones En blanco si se trata de una transacción abonada. | Alfanumérico | 2 | 70 |

| Liq-Fedi | Fecha de Liquidación Formato ‘dd/mm/aa’ Corresponde a la fecha de abono de la transacción respectiva | Alfanumérico | 8 | 78 |

| Liq-nro-unico | Número único | Alfanumérico | 26 | 104 |

| Liq-com-comiv | Valor de la comisión más IVA de la comisión (Venta). 11 enteros 2 decimales | Numérico | 13 | 117 |

| Liq-cad-cadiva | N/A Se rellena el largo con “0”. 11 enteros 2 decimales | Numérico | 13 | 130 |

| Liq-decom-ivcom | Valor de la comisión más IVA de la comisión(Retenciones). 11 enteros 2 decimales | Numérico | 13 | 143 |

| Liq-dcoad-ivcom | N/A Se rellena el largo con “0”. 11 enteros 2 decimales | Numérico | 13 | 156 |

| Liq_prepago | Prepago Valor “P” para registros que provienen de prepago. En blanco si se trata de una transacción de otro producto. | Alfanumérico | 1 | 157 |

| Liq_Nombre_banco | Nombre del banco se indicará el nombre del banco | Alfabético | 35 | 192 |

| Liq_Tipo_cuenta_banco | Tipo de la cuenta del banco asociada al abono | Alfabético | 2 | 194 |

| Liq_Número_cuenta_banco | Número de la cuenta del banco asociada al abono | Alfabético | 18 | 212 |

| Liq_Moneda_cuenta_banco | Moneda de la cuenta de abono seleccionada | Alfabético | 3 | 215 |

Notas

- Todos los campos “Fecha de Proceso” explicados en este documento aplican a la Fecha de Proceso del archivo

- La siguiente tabla indica qué transacciones pueden ocurrir tanto a través de Host como POS de contingencia, y cuáles solo a través de una de ambas vías:

| Tipo de transacción | |||

| Código de Transacción | 210 | 220 | 420 |

|---|---|---|---|

| 10 | Host - POS | Host - POS | Host - POS |

| 13 | Webpay | Webpay | |

| 14 | POS - Webpay | Host | Host - POS - Webpay |

| 18 | Host - POS | Host - POS | |

- Para las aplicaciones con mensajería SPDH 3.1 las transacciones de anulación efectuadas a través del Host son consideradas como FS04 (fuera de línea), lo que en el archivo quedaría representado como una 220-14

- Para efectos de parear transacciones, solo se deben considerar los registros con código de transacción “10” (Compras), “13” (WebPay) y “18” (Compra con vuelto).

- Para los registros correspondientes a transacciones retenidas (Código de Transacción “30”), se informarán solamente los siguientes campos: o Fecha de Transacción (Dktt-Dt-Tran-Dat) o Código de comercio (Dktt-Dt-Id-Retailer) o Número de Único (DSK-ID-NUM-UNICO) o Monto de la transacción (Dktt-Dt-Amt-1)

- Para el caso de Liquidación el campo (liq-vci), podrá contener los valores TSY (correctamente autenticada), ya que muestras solo autorizaciones ok nacionales. En el caso de una transacción internacional, podrás visualizar TSY y A (intento de autenticación)

- En los casos de archivo de cuadratura, el campo (Dktt-Dt-VCI) además de los casos anteriores, también existirán los rechazos con TO (TimeOut) y TSN (Transacción no autenticada).

Archivo de saldos

Considera los saldos contables pendientes de abono para los productos Crédito ($ y US$) y Débito. Contiene todas las transacciones que se encuentran procesadas hasta el cierre contable (último día de proceso hasta las 14:00 hrs.) y que se encuentran pendientes de abono (ventas) o cargo (retenciones).

Material disponible en la casilla

- Detalle Saldos Contables Pendientes de abono; Archivo que contiene todas las transacciones pendientes de abono que respaldan el informe disponible en portal

- Detalle transacciones al cierre de Mes; Archivo que presenta el detalle de transacciones al cierre del mes, que no han sido procesadas dentro del mes y que no conforman el informe de saldo pendientes de abono. Para cada casilla de cliente se le creará una carpeta llamada CARTOLA_SALDOS, dentro de ella estará todos los archivos en donde su nombre identificará con PREFIJO_FECHA_RUT (DET_DDMMYYY_XXXXXXXXX).

DET_31102018_761349465. (.txt) COL_31122018_761349465. (.txt)

Estructura de archivo de texto

| Campo | Tipo Dato | Largo |

|---|---|---|

| FECHA PROCESO | DATE | |

| RUT COMERCIO | STRING | 9 |

| CÓDIGO COMERCIO | STRING | 8 |

| TIPO CONTRATO | STRING | 2 |

| DESCRIPCIÓN TIPO CONTRATO | STRING | 13 |

| TIPO FLUJO | STRING | 4 |

| DESCRIPCIÓN TIPO FLUJO | STRING | 2 |

| FECHA VENTA | DATE | |

| FECHA ABONO | DATE | |

| TARJETA | STRING | 19 |

| NRO CUOTA | NUMBER | 2 |

| MONTO CUOTA | NUMBER | 17,2 |

| LNIN SEC | NUMBER | 23 |

| FECHA PROCESO TXS | DATE | |

| MONTO VENTA | NUMBER | 17,2 |

| CÓDIGO AUTORIZACIÓN | STRING | 6 |

| ORDEN PEDIDO | STRING | 26 |

| ID SERVICIO | STRING | 20 |

| PAREADA | STRING | 2 |

Estructura nombres archivos saldos

Los nombres de archivos tendrán una nueva estructura, según el siguiente detalle:

<Formato de Salida>_<Periodo>_<Agrupación Archivo de Salidas>_<Agrupación de Transacciones>_<RutEnrolado ó CódigoComercio>_<Tipo Conexion><Modo Agrupación><Formato de Salida> corresponde al formato de salida:

LDN = Liquidación de débito

LCN = Liquidación de crédito

CDN = Cuadratura de débito

CCN = Cuadratura de crédito

<Periodo> corresponde a la fecha en formato DDMMAAAA, según la frecuencia

configurada:

- Diaria: Se genera un archivo diario en base a la fecha de proceso; esta es la frecuencia por defecto

- Mensual: Se genera un archivo por mes. Fecha asociada al penúltimo día hábil del mes

<Agrupación Archivo de Salidas> corresponde a la naturaleza de agrupación:

- RE: Archivo con información única asociada al RUT enrolado (Genera un archivo)

- CC: Archivo con información separada por código de comercio de la transacción (genera un archivo diferente para cada código de comercio)

<Tipo Conexión> corresponde al tipo de conexión de los códigos de comercio:

- UN: Se genera un único archivo. Información de archivos no es separada por tipo de conexión (cuando es un archivo único no es parte del nombre)

- SE: Se genera un archivo para transacciones con tipo de conexión presencial y no presencial

- NP: No presencial

- PR: presencial

<Modo Agrupación> corresponde al modo de agrupación de los códigos de comercio

SC: Sucursal Matriz (cuando está agrupado por RUT no se incluye en el nombre

del archivo)

RB: Rubro

Procedimiento enlace y conexión Pinpad Bluetooth e355

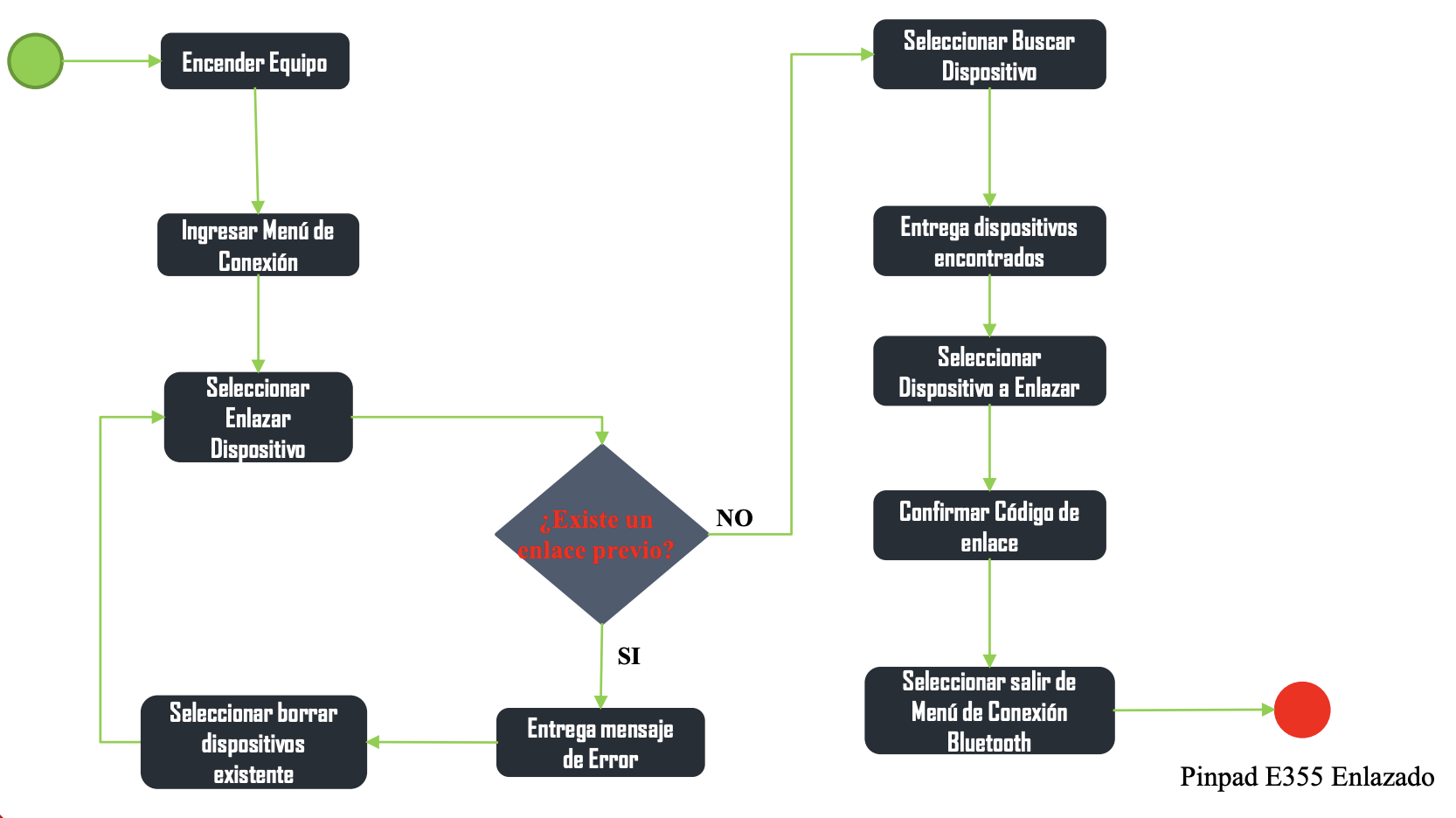

Flujo de enlace Pinpad Bluetooth

Conexion Pinpad Bluetooth E355

Encendido de equipo

Paso 1

Al encender el equipo entra a la pantalla principal del aplicativo.

Paso 2

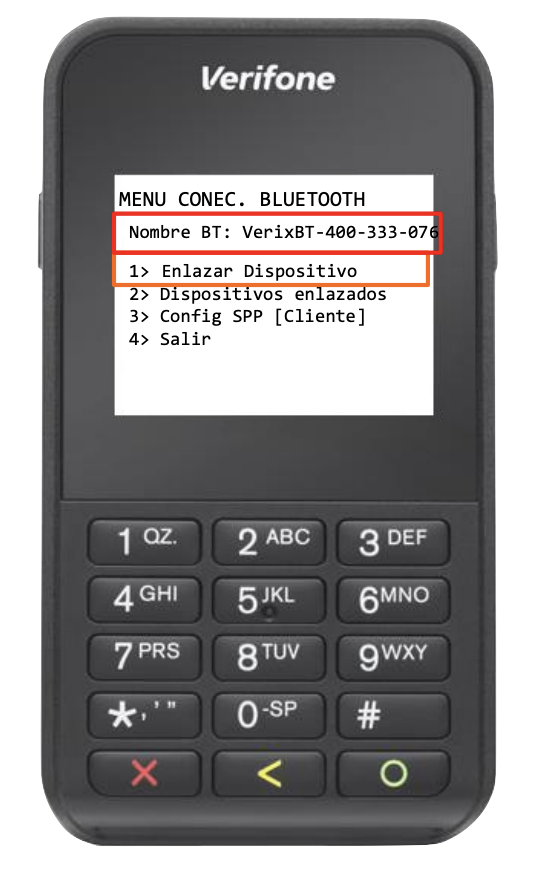

Se debe digitar secuencial mente las teclas “* 0 ” para ingresar al “Menú de Conexión Bluetooth.

Enlazar dispositivos

Paso 3

En el Menú de conexión bluetooth. Se selecciona la opción 1> Enlazar Dispositivo

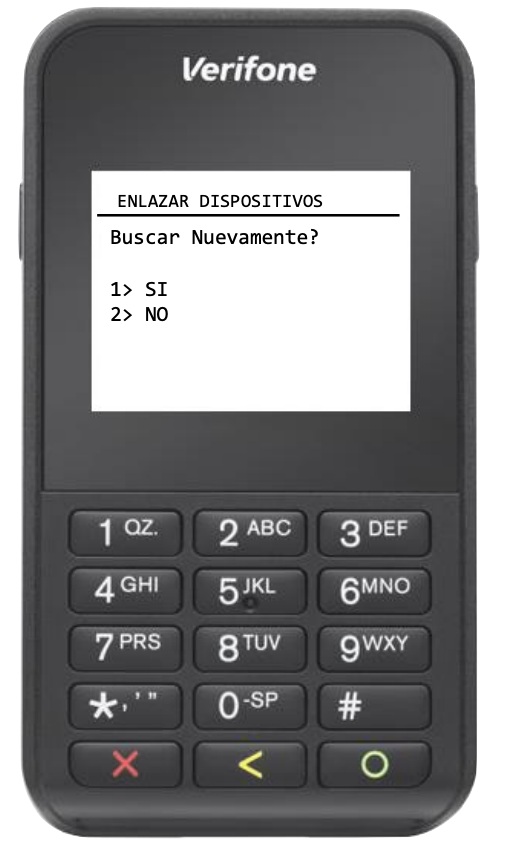

Paso 4

Si anteriormente se realizo una búsqueda preguntara si desea Buscar nuevamente, si presiona 2> NO mostrara los dispositivos encontrados en la búsqueda anterior.

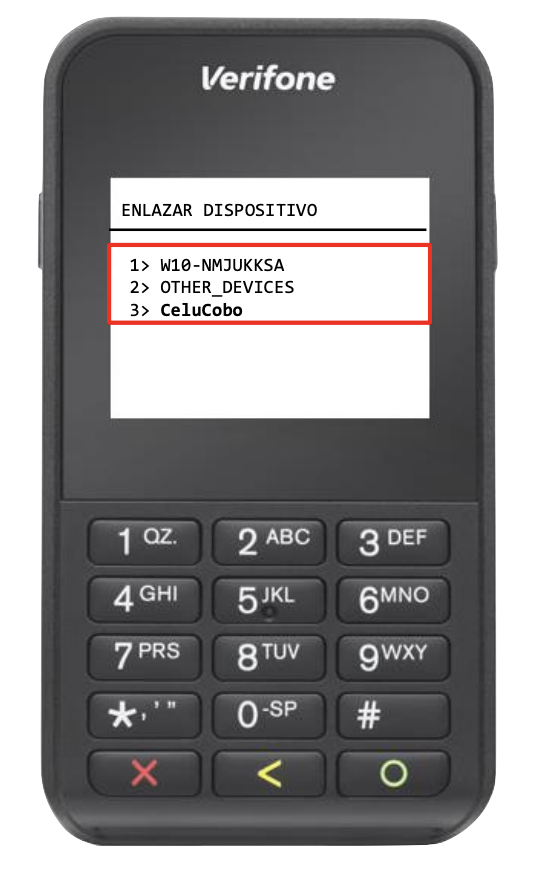

El BT Name, que es el nombre que será visible al resto de dispositivos Bluetooth

Paso 5

Al finalizar la búsqueda muestra los dispositivos encontrados

Paso 6

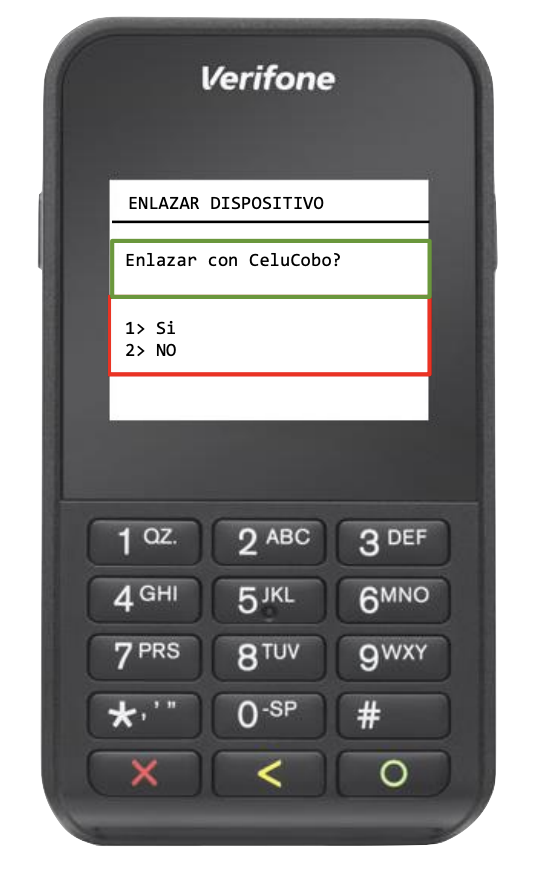

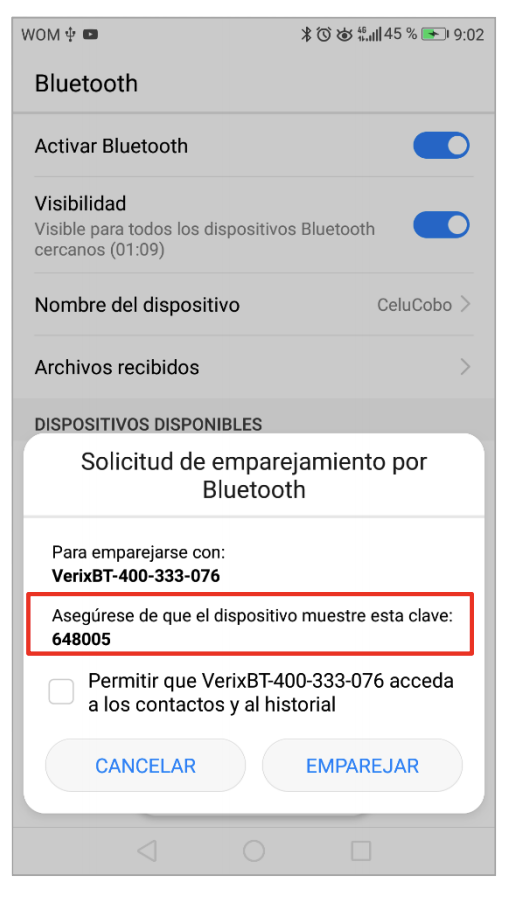

Al seleccionar un dispositivo aparecerá esta ventana para confirmar el enlace.

Paso 7

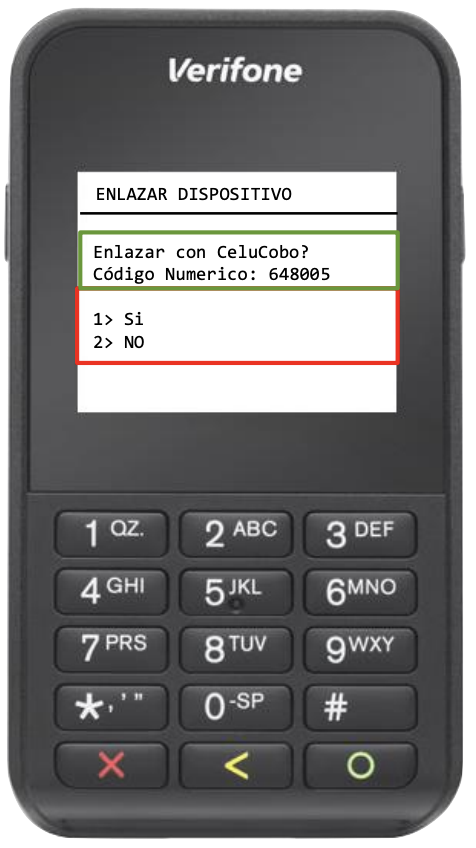

Al seleccionar el dispositivo aparecerá esta ventana para confirmar el enlace.

Un mensaje similar aparecerá en el otro dispositivo, el código que aparece deberá ser el mismo en ambos dispositivos; En este caso 648005 Y seleccionamos YES y quedaran enlazados

Paso 8

Comercio debe aceptar la conexión Bluetooth.

Se debe coordina la visita al comercio - Contraparte Comercio

Revisar habilitación SPP

SPP: Serial Profile interfaz (interfaz que emula una conexión puerto serie) se debe configurar en caso que este deshabilitado

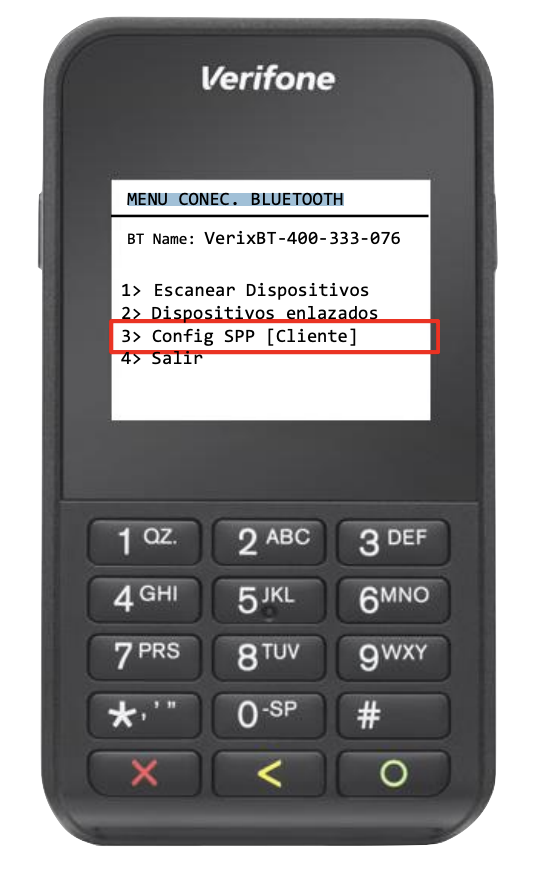

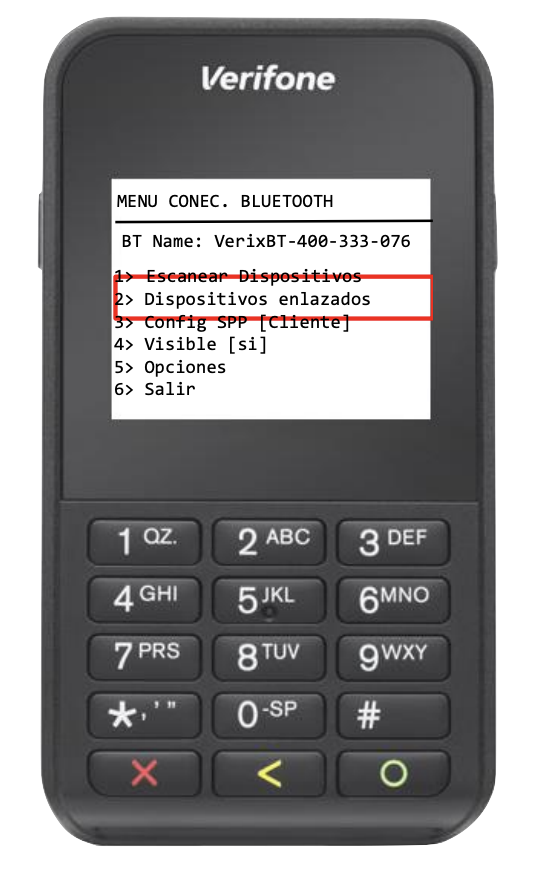

Paso 1

En el Menú Principal del administrador de bluetooth. Si se Requiere habilitar SSP (Serial Port Profile) 3> Config MENU CONEC. BLUETOOTH SPP [Desactivado]

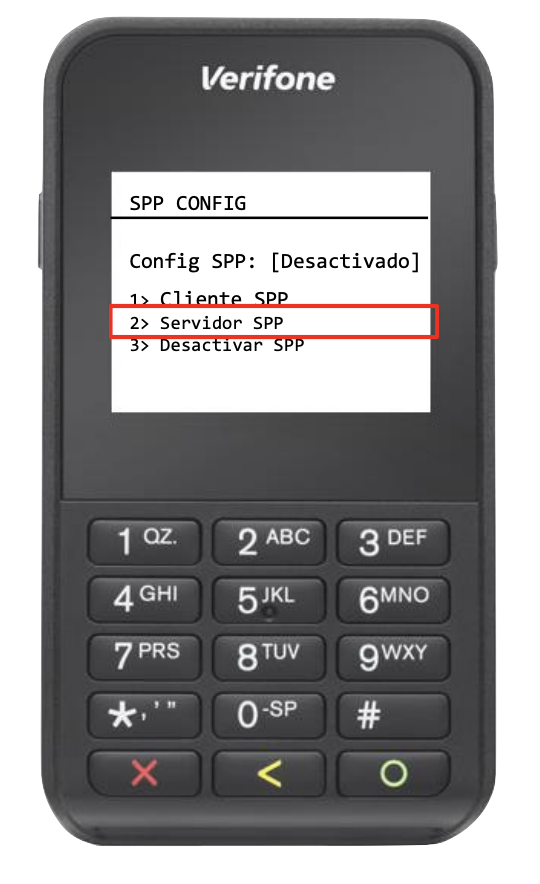

Paso 2

Selecciona la opción 2> Servidor SPP

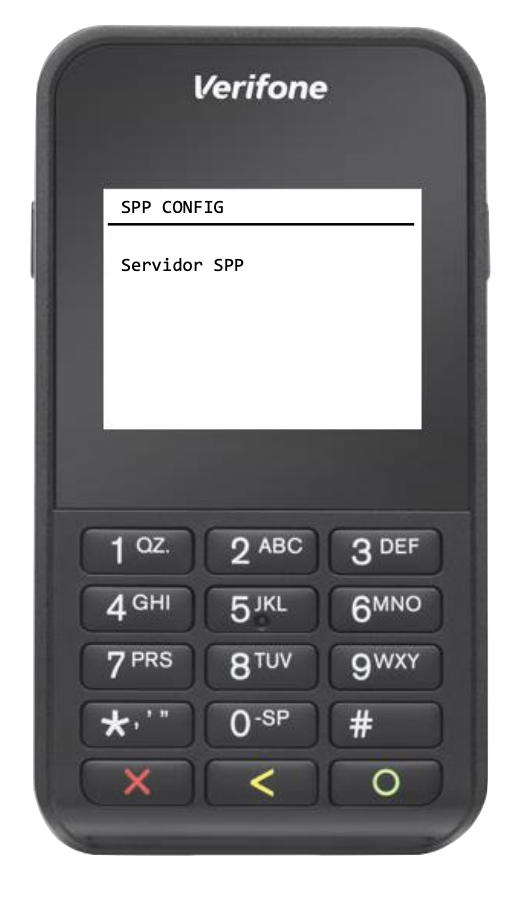

Paso 3

Aparecerá esta Pantalla y Volverá al menú Principal

Borrar equipos enlazados

Paso 1

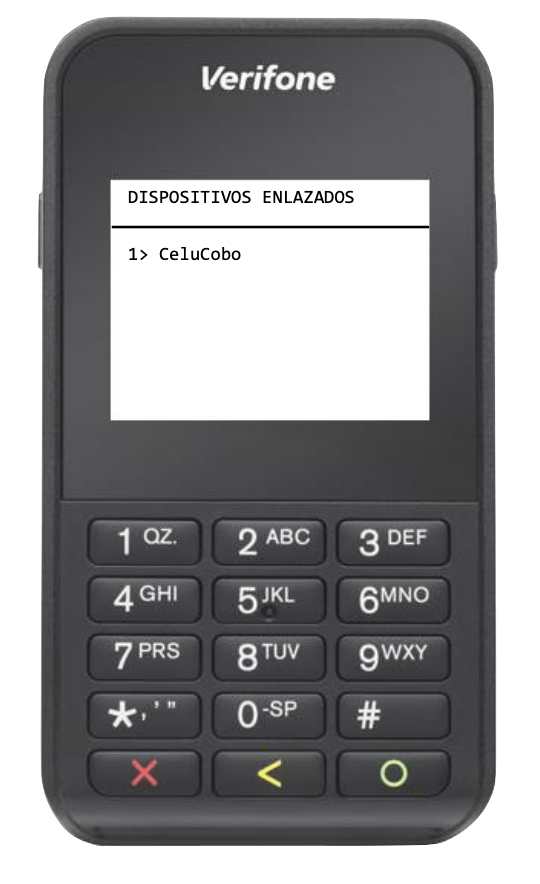

En el Menú del Administrador de Bluetooth, seleccionar la opción 2> Dispositivos Enlazados

Paso 2

En esta opción se mostrará un menú con todos los dispositivos que están enlazados con el pinpad e355, quedan registrados los dispositivos anteriormente enlazados.

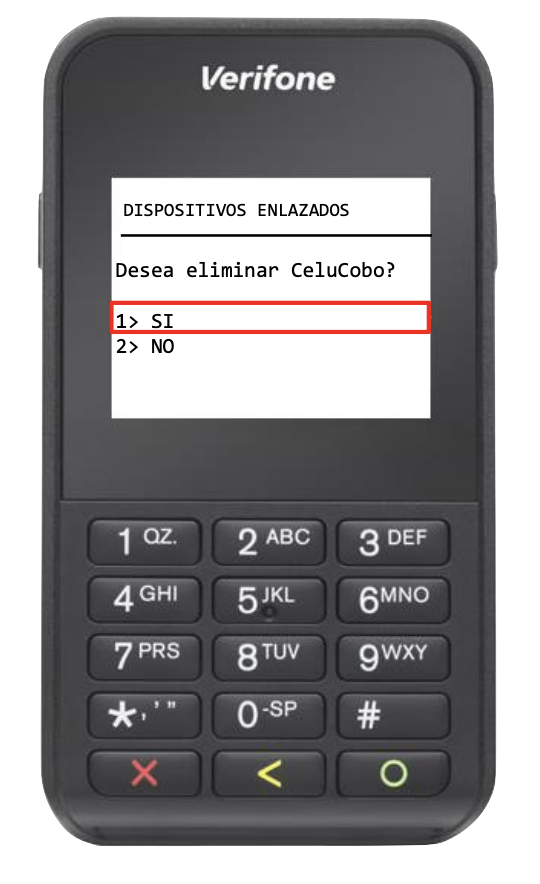

Paso 3

Si seleccionamos el dispositivo, aparecerá este menú que nos mostrar 2 opciones. Si seleccionamos SI eliminamos el enlace, y volvemos al menú principal.

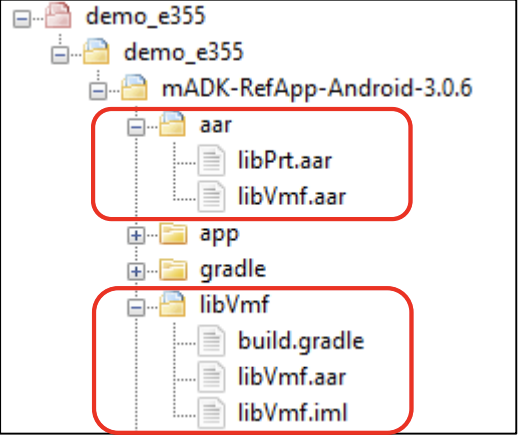

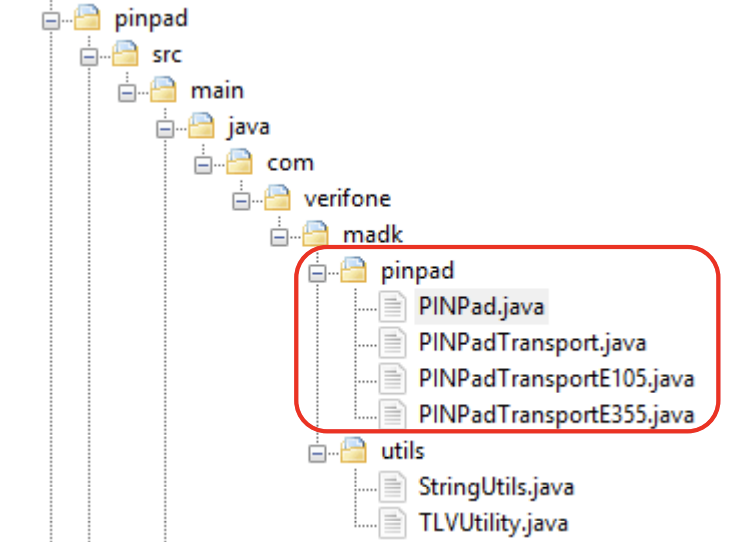

Utilización del SDK

Para la integración con aplicaciones propias del

comercio, es necesario utilizar en los desarrollos

propios, las librerías incluidas en el SDK del equipo

Verifone e355.

Estas son:

libPtr

libVmf

Para facilitar el proceso de integración se utiliza la referencia al recurso “pinpad” que contiene funciones para la comunicación entre Pinpad y la App del Comercio. La estructura y el código de ejemplo están incluidos en el archivo demo_e355.zip

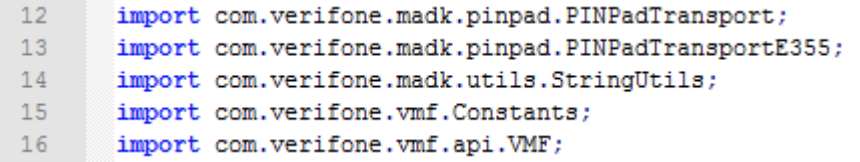

Importación de librerías y recurso Pinpad

Declaración del activity principal y PINPadTransport

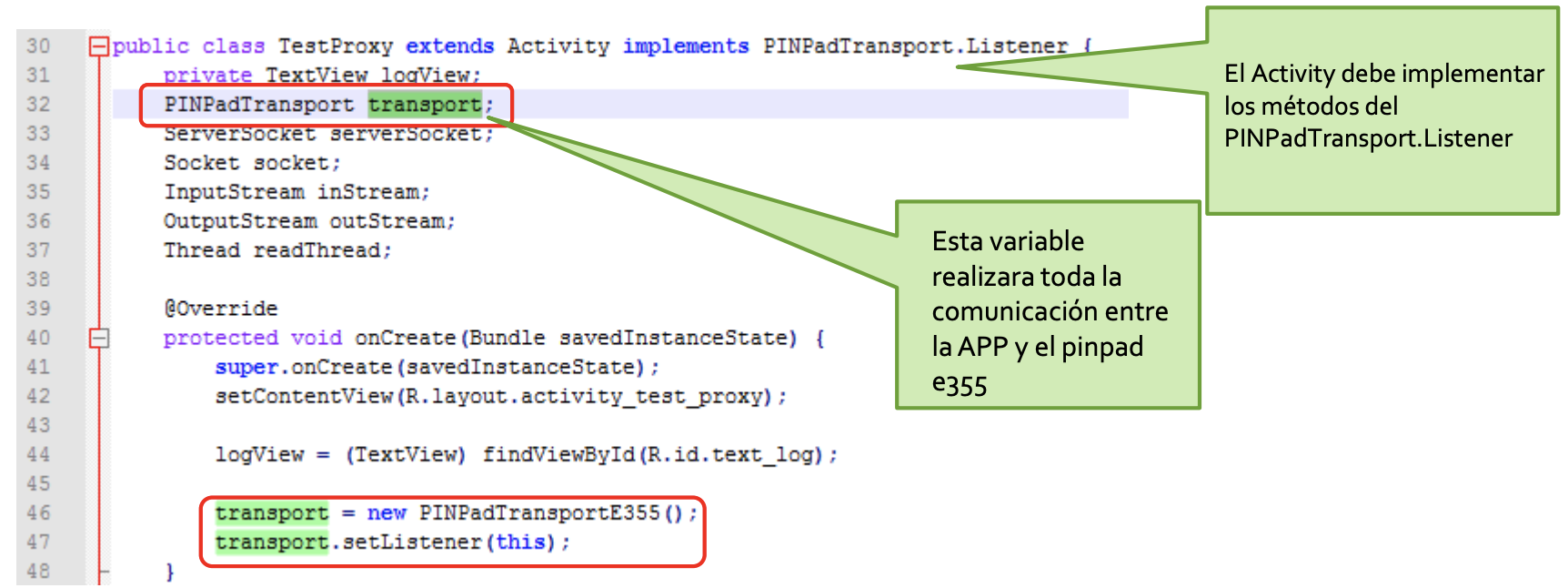

Función para la conexión y desconexión

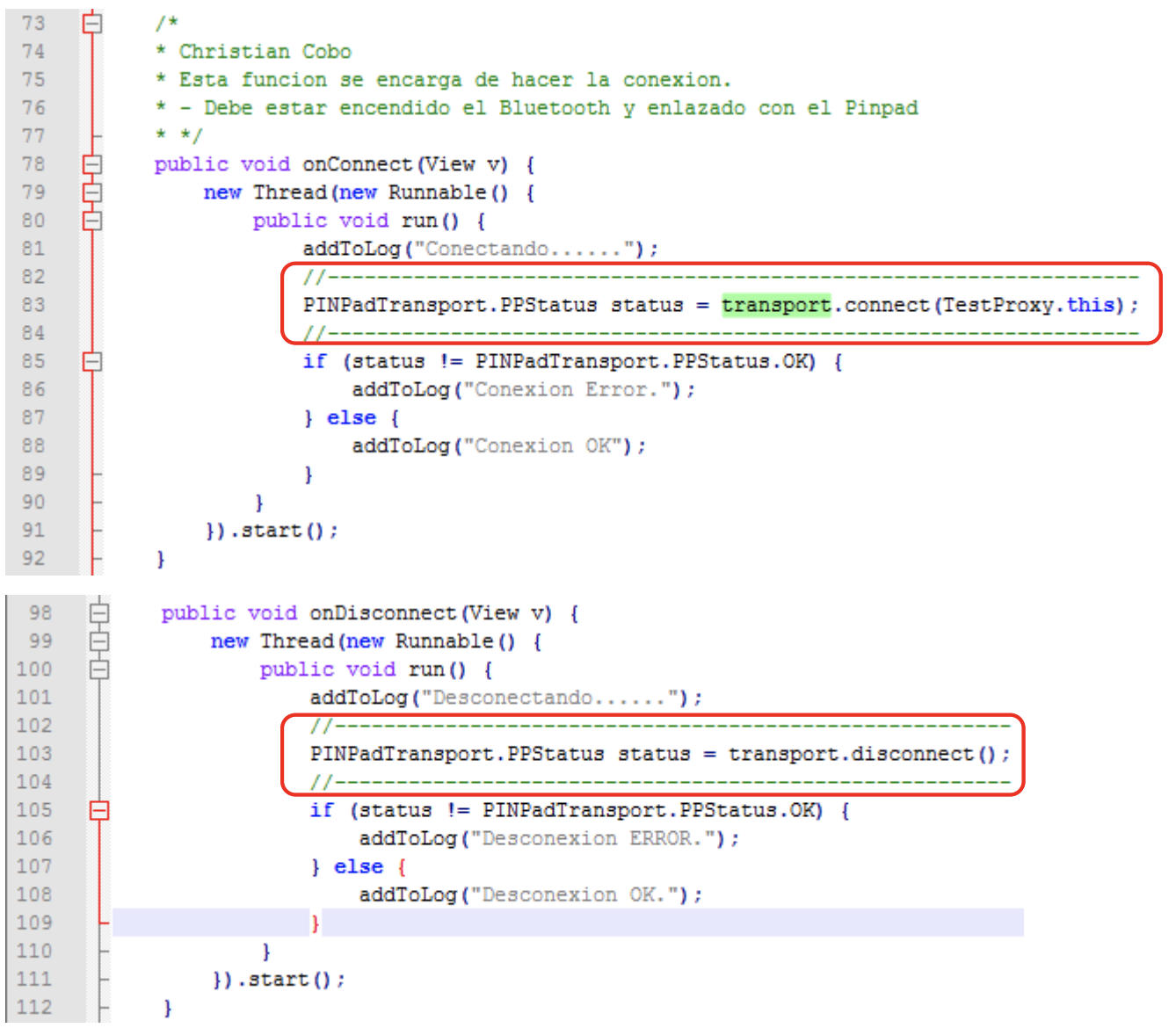

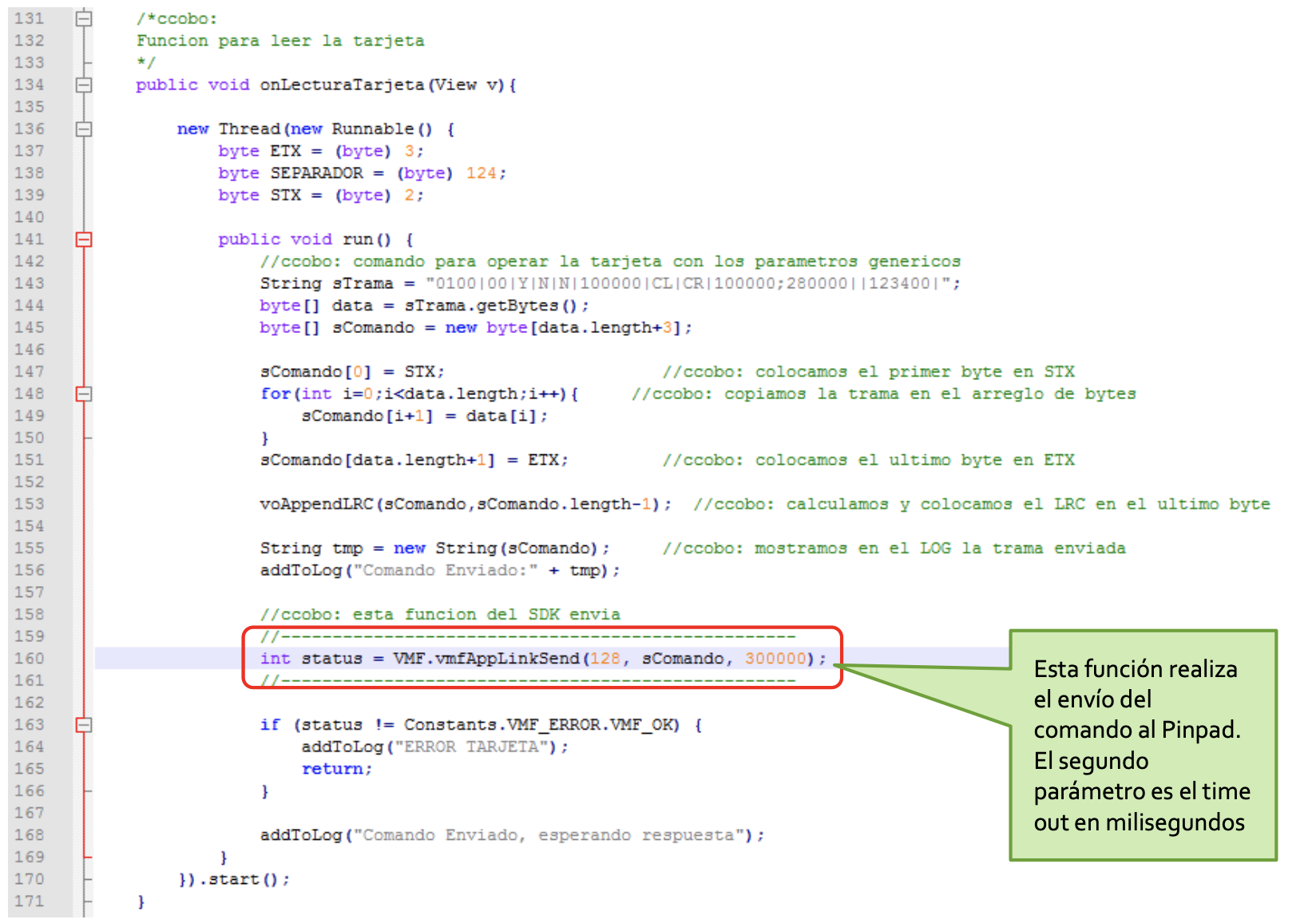

Ejemplo para enviar el comando 0100 (lectura tarjeta al pinpad) al Pinpad

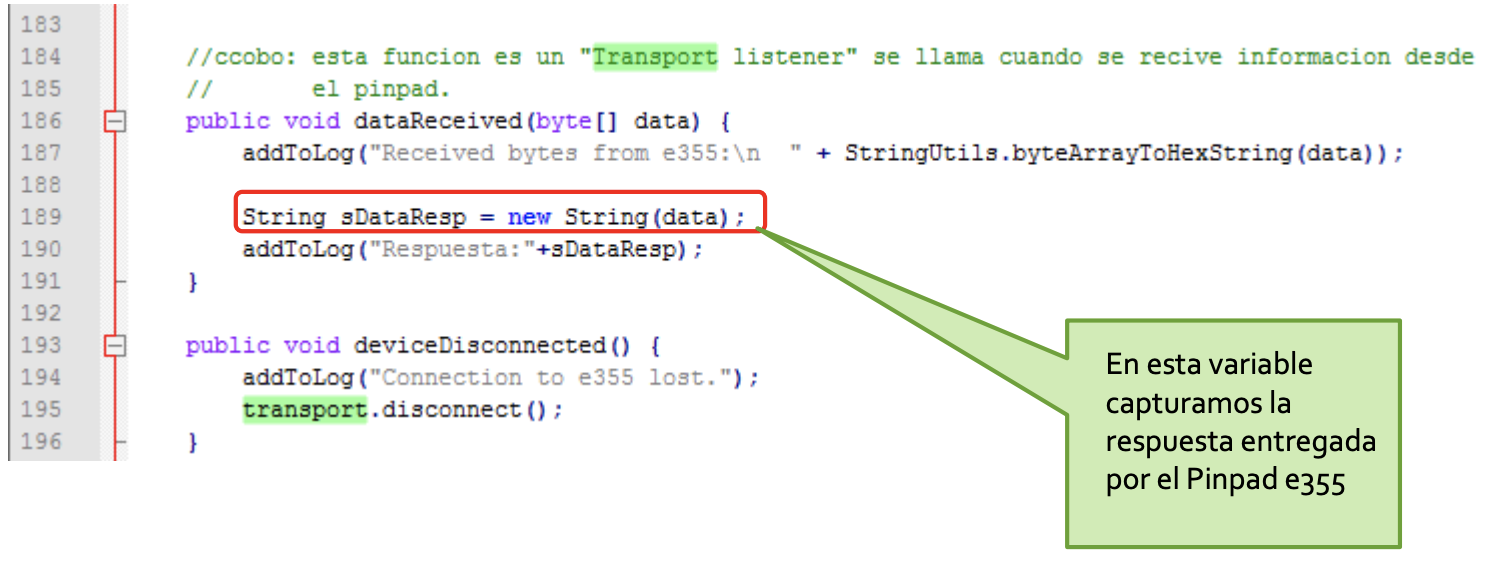

Función para recibir la respuesta del Pinpad

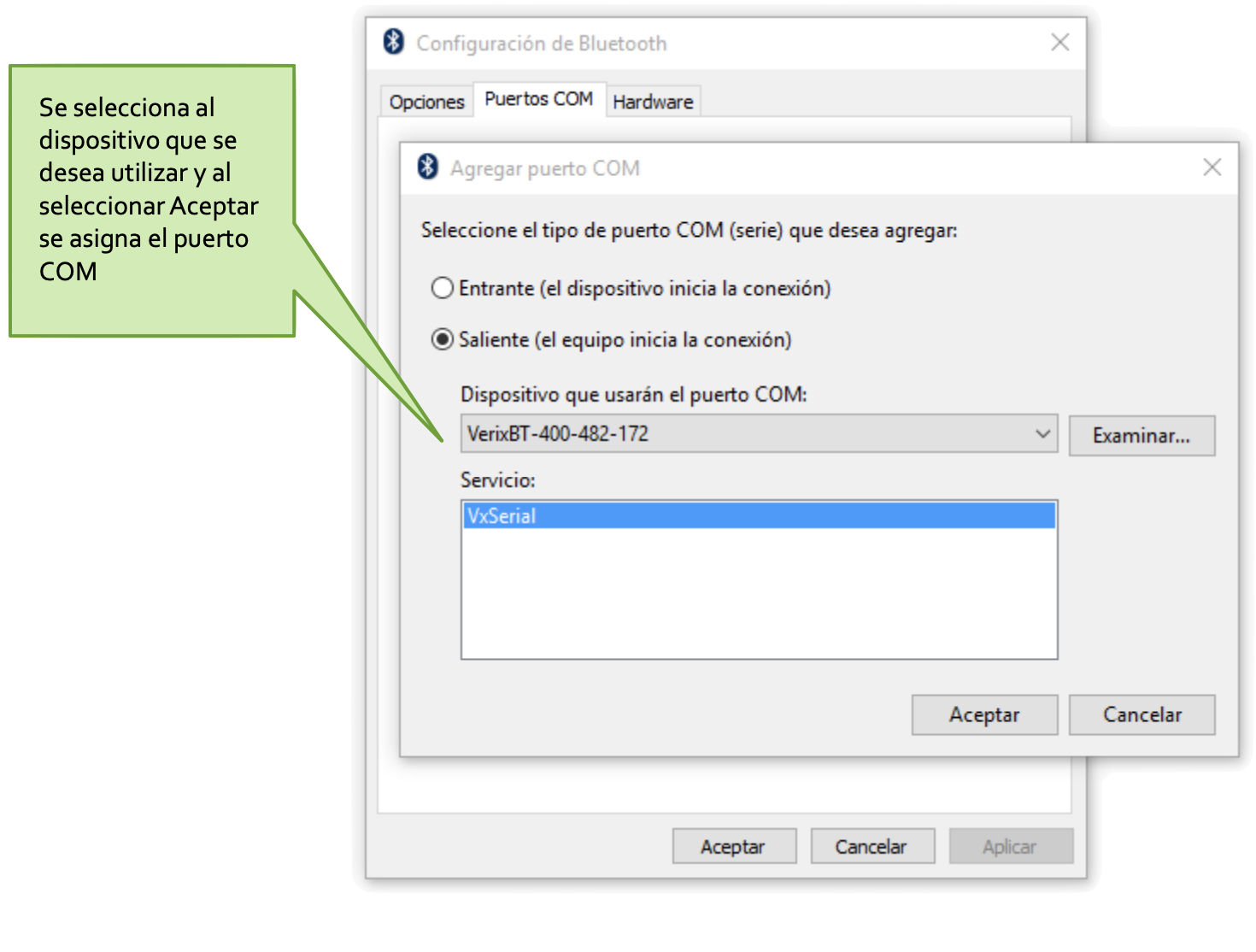

Instalación en Windows

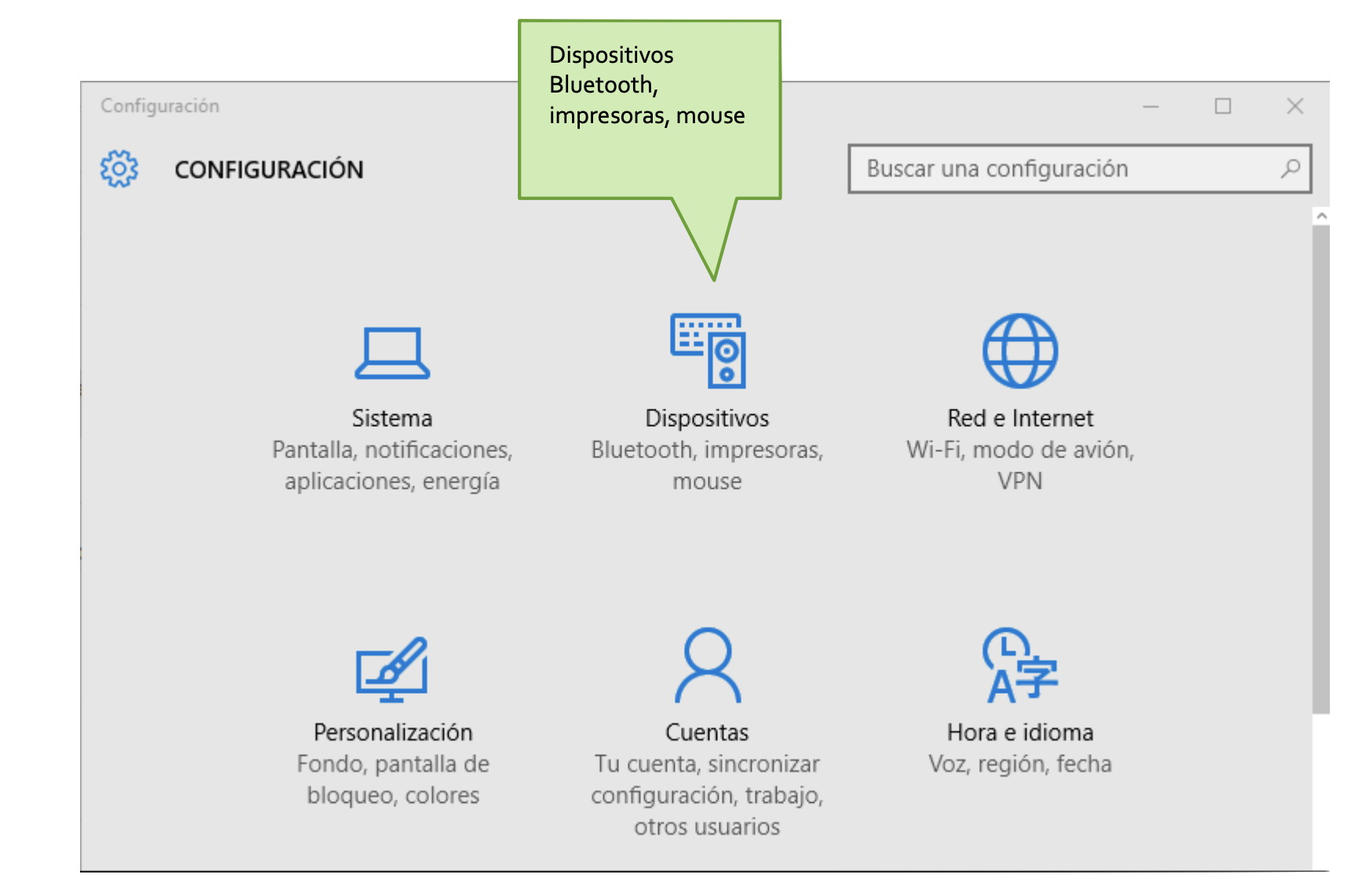

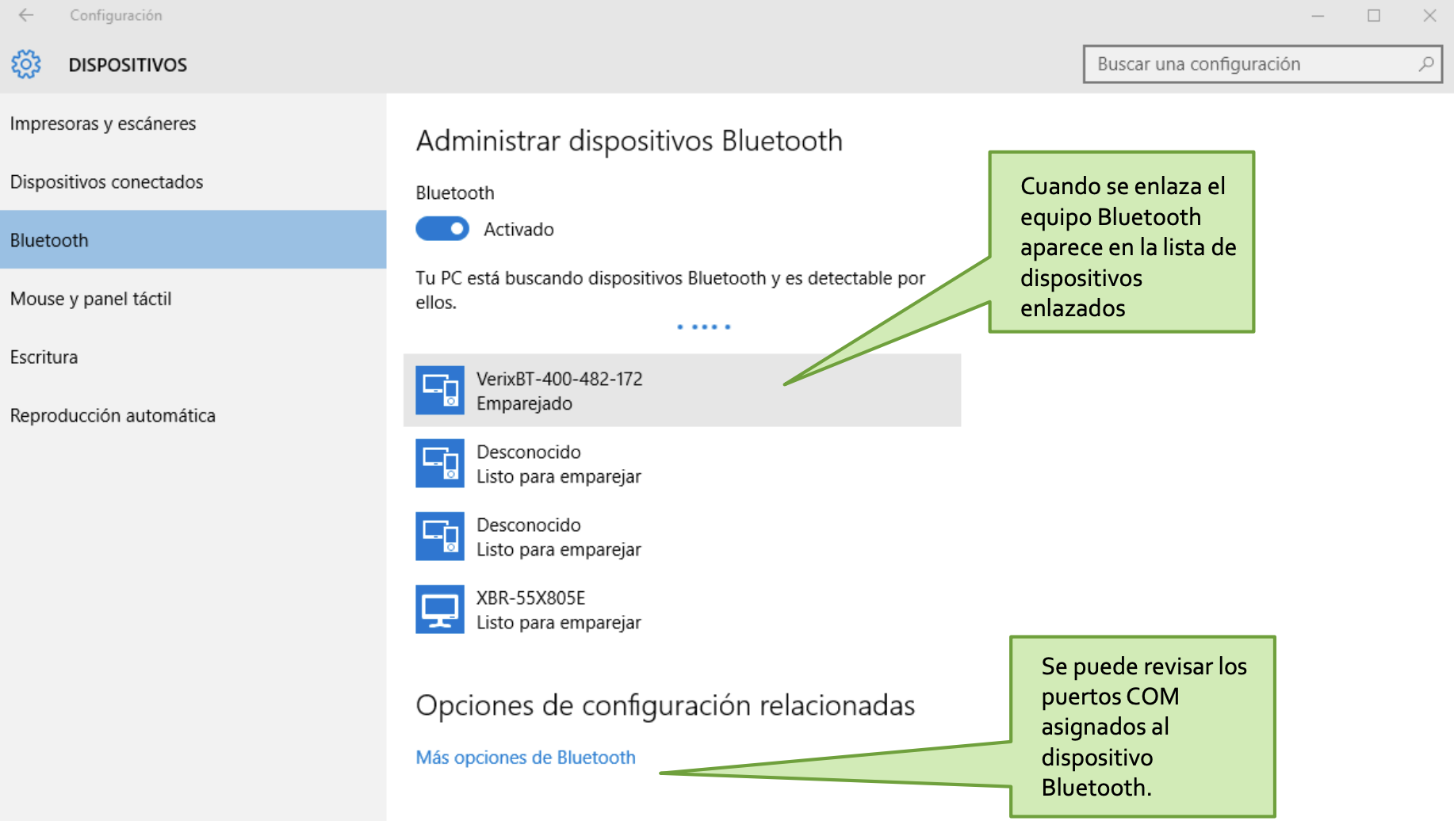

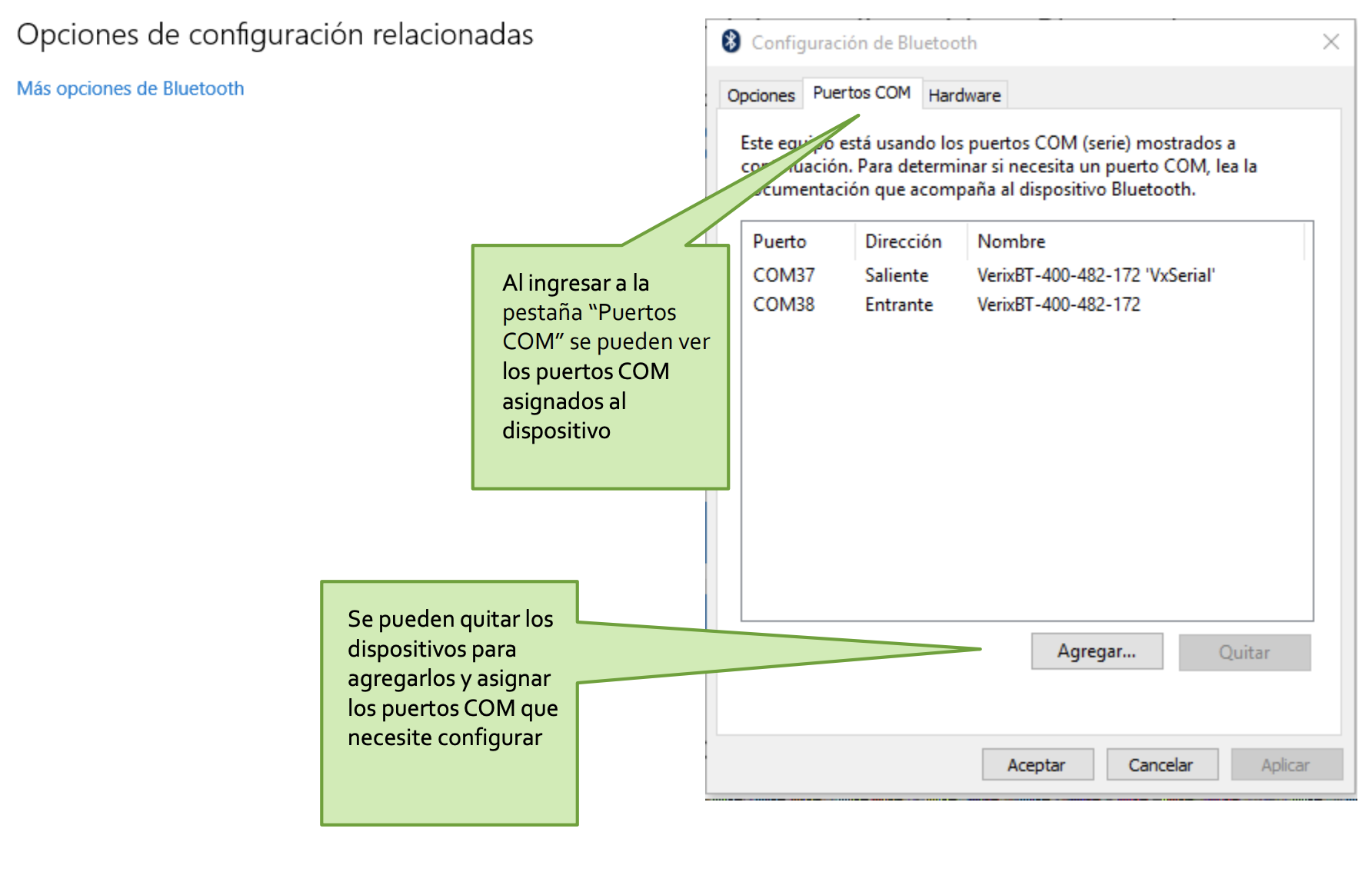

Cuando se realiza el enlace se crean 2 puertos COM que se enlazan al Bluetooth. Para poder revisarlo se debe ingresar a: Dispositivos

Paso 1

Paso 2

Paso 3

Paso 4